Having a credit card offers a world of convenience and financial security. From online shopping to building credit history for larger loans, credit cards play a vital role. So how to approve a credit card, especially if you have a negative score?

For those with a negative score on their credit report, obtaining a credit card can feel like an impossible task.

But fear not! Here, we’ll explore strategies to build trust with potential issuers and increase your chances of credit card approval, even with a negative score.

Understanding Your Negative Score

The first step is understanding why your credit score is negative. Common reasons include late payments on bills, exceeding credit card limits, or defaulting on loans.

It’s crucial to obtain a free copy of your credit report from each bureau to identify any errors. These reports are available online or through physical branches.

Most Brazilians Do Not Own a Credit Card

Obtaining a credit card in Brazil can be a hurdle for some, despite its widespread use. Here, we’ll explore three main reasons why Brazilians might face credit card application denials:

1. Lack of Banking Access

A significant portion of the Brazilian population remains unbanked. Statistics show over 55 million adults lack a bank account, with more than 20 million entirely excluded from the banking system. This directly impacts credit card accessibility, as credit card issuers typically require a banking relationship to assess financial history and eligibility.

2. Negative Credit Report (Serasa)

Serasa, a prominent Brazilian credit bureau, maintains a comprehensive database on individuals and businesses, including their debt status. This information is crucial for banks when evaluating credit card applications. Having a “nome sujo” (dirty name) on your Serasa report, indicating past delinquencies, significantly reduces your chances of approval.

3. High Debt-to-Income Ratio

Even with a clean credit history, Brazilians might encounter denials if their debt obligations are deemed excessive. Banks often consider the debt-to-income ratio (DTI), which compares monthly debt payments to income. If more than 30% of your income is already allocated to existing debts like loans or installments, it can signal a higher risk to the bank, leading to a credit card application rejection.

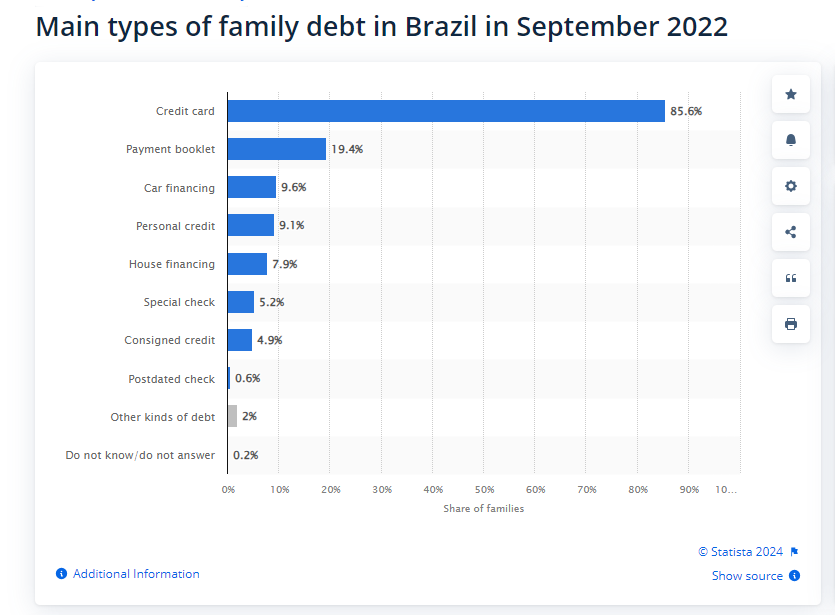

According to Statista, credit cards were the most common form of debt among indebted families in Brazil in September 2022. The survey found that a staggering 85.6 percent of respondents reported having credit card debt. This statistic highlights the prevalence of credit cards in Brazil’s financial landscape.

Building Trust and Improving Your Score

Building trust with credit card issuers requires demonstrating responsible credit behavior. Here are key strategies to build trust with your bank:

Conquering Payment Habits

Make on-time payments your top priority. Set up automatic payments or reminders to avoid missed deadlines.

Remember, even one late payment can significantly impact your score.

Taming Credit Utilization

Credit utilization refers to the percentage of your credit limit you’re using. Ideally, keep this ratio below 30%.

Focus on paying down existing credit card balances and avoid maxing out your cards.

Building a Credit Mix

Having a healthy mix of credit accounts, like credit cards and installment loans, shows responsible credit management.

Secured credit cards, which require a security deposit that becomes your credit limit, are a great option to build a positive history.

Minimizing Credit Inquiries

Applying for too many credit cards in a short period can negatively impact your score.

Research cards that fit your needs and apply strategically, only for those with a high chance of approval.

Building Trust with Issuers

While a good credit score plays a significant role, there are other ways to build trust with issuers:

The Power of a Co-signer

Enlisting a co-signer with a good credit history can significantly improve your approval odds.

Just remember, both you and the co-signer are responsible for the debt, so choose someone you trust completely and understand the commitment involved.

Secured Credit Cards

As mentioned earlier, secured credit cards are a fantastic tool for those with a negative score.

By using a secured card responsibly and making on-time payments, you can gradually build a positive credit history.

Once your score improves, you may transition to a traditional credit card.

Credit Builder Loans

Consider a credit builder loan as an alternative. These installment loans help establish a positive credit history by reporting your on-time payments to credit bureaus.

Once you repay the loan, the funds are typically returned to you.

Conclusion: Patience is Key

Rebuilding a negative score takes time and responsible credit management. By consistently making on-time payments, reducing credit card debt, and strategically utilizing credit-building tools, you can demonstrate your trustworthiness to issuers.

Remember, a good credit score opens doors to better interest rates, loan options, and financial opportunities. Take action today, and watch your credit score – and your financial future – improve!