[rio-emi-calculator]

Contents

- 1 Outline

- 2 Understanding Car Loan EMI: Your Complete Guide

- 2.1 Introduction

- 2.2 Basics of Car Loan EMI

- 2.3 How Car Loan EMI Works

- 2.4 Types of Car Loans

- 2.5 Factors Affecting Car Loan EMI

- 2.6 Calculating Your Car Loan EMI

- 2.7 Benefits of Knowing Your EMI

- 2.8 Tips to Manage Your Car Loan EMI

- 2.9 Common Mistakes to Avoid

- 2.10 Comparing Car Loan Offers

- 2.11 Impact of Credit Score on EMI

- 2.12 Refinancing Your Car Loan

- 2.13 Top Banks and Financial Institutions for Car Loans

- 2.14 Conclusion

- 2.15 FAQs

Outline

- Introduction

- What is Car Loan EMI?

- Importance of Understanding EMI

- Basics of Car Loan EMI

- Definition of EMI

- Components of EMI: Principal and Interest

- How Car Loan EMI Works

- The EMI Calculation Formula

- The Role of Interest Rates

- Types of Car Loans

- Secured vs. Unsecured Car Loans

- Fixed vs. Floating Interest Rates

- Factors Affecting Car Loan EMI

- Loan Amount

- Interest Rate

- Loan Tenure

- Down Payment

- Calculating Your Car Loan EMI

- Using an EMI Calculator

- Manual Calculation

- Benefits of Knowing Your EMI

- Budgeting and Financial Planning

- Avoiding Defaults

- Tips to Manage Your Car Loan EMI

- Opting for a Longer Tenure

- Making Larger Down Payments

- Prepaying the Loan

- Common Mistakes to Avoid

- Ignoring the Total Cost of the Loan

- Overestimating Your Repayment Capacity

- Comparing Car Loan Offers

- Interest Rates

- Additional Charges and Fees

- Flexibility in Repayment

- Impact of Credit Score on EMI

- Understanding Credit Score

- Improving Your Credit Score

- Refinancing Your Car Loan

- When to Consider Refinancing

- Benefits of Refinancing

- Top Banks and Financial Institutions for Car Loans

- Popular Banks Offering Car Loans

- Key Features of Their Car Loan Products

- Frequently Asked Questions (FAQs)

- How to Choose the Best Car Loan?

- What Happens If I Miss an EMI Payment?

- Can I Change My EMI Payment Date?

- Conclusion

- Recap of Key Points

- Final Thoughts

Understanding Car Loan EMI: Your Complete Guide

Introduction

Buying a car is an exciting milestone, but understanding how to finance it is crucial. Have you ever wondered what exactly car loan EMI is and why it’s so important? Let’s dive in!

Basics of Car Loan EMI

What is Car Loan EMI?

EMI stands for Equated Monthly Installment. It’s the fixed amount you pay every month to repay your car loan. This amount includes both the principal (the original loan amount) and the interest.

Components of EMI: Principal and Interest

Your EMI has two main parts:

- Principal: The amount you borrowed.

- Interest: The cost of borrowing that amount.

How Car Loan EMI Works

The EMI Calculation Formula

EMI is calculated using a formula: EMI=𝑃×𝑅×(1+𝑅)𝑁(1+𝑅)𝑁−1 where:

- 𝑃 = Principal loan amount

- 𝑅 = Monthly interest rate

- 𝑁 = Number of monthly installments

The Role of Interest Rates

Interest rates can be fixed or floating, impacting how much you pay each month. Higher interest rates mean higher EMIs.

Types of Car Loans

Secured vs. Unsecured Car Loans

- Secured Loans: These are backed by collateral (like the car itself).

- Unsecured Loans: No collateral needed, but interest rates are usually higher.

Fixed vs. Floating Interest Rates

- Fixed Rates: Stay the same throughout the loan tenure.

- Floating Rates: Change based on market conditions.

Factors Affecting Car Loan EMI

Loan Amount

The bigger the loan, the higher the EMI.

Interest Rate

Higher interest rates increase your EMI.

Loan Tenure

Longer tenures reduce the monthly EMI but increase the total interest paid.

Down Payment

A larger down payment reduces the loan amount and, consequently, the EMI.

Calculating Your Car Loan EMI

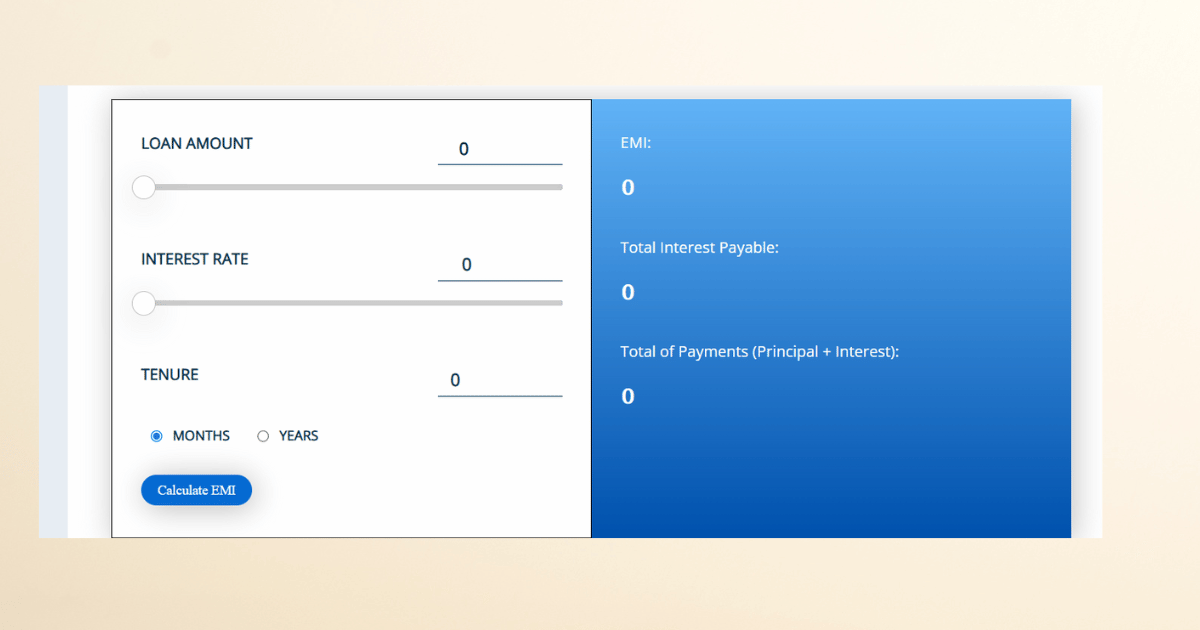

Using an EMI Calculator

Online EMI calculators make it easy to figure out your monthly payments. Just input the loan amount, interest rate, and tenure.

Manual Calculation

If you’re up for it, you can use the EMI formula to calculate it yourself.

Benefits of Knowing Your EMI

Budgeting and Financial Planning

Knowing your EMI helps you plan your finances better and ensures you can afford your monthly payments.

Avoiding Defaults

Understanding your EMI and budgeting accordingly helps you avoid missing payments and the penalties that come with it.

Tips to Manage Your Car Loan EMI

Opting for a Longer Tenure

This reduces your monthly EMI but means you’ll pay more interest overall.

Making Larger Down Payments

Reducing the principal amount through a bigger down payment can significantly lower your EMI.

Prepaying the Loan

If you have extra funds, consider prepaying part of your loan to reduce the principal and, thus, the EMI.

Common Mistakes to Avoid

Ignoring the Total Cost of the Loan

Always consider the total amount you’ll pay over the loan tenure, not just the EMI.

Overestimating Your Repayment Capacity

Be realistic about what you can afford monthly to avoid financial strain.

Comparing Car Loan Offers

Interest Rates

Compare rates from different lenders to get the best deal.

Additional Charges and Fees

Look out for processing fees, late payment charges, and other hidden costs.

Flexibility in Repayment

Choose a loan that offers flexibility in repayment terms.

Impact of Credit Score on EMI

Understanding Credit Score

Your credit score affects the interest rate you’re offered. A higher score usually means a lower rate.

Improving Your Credit Score

Pay your bills on time, reduce debt, and avoid applying for multiple loans simultaneously to improve your score.

Refinancing Your Car Loan

When to Consider Refinancing

If interest rates drop or your financial situation improves, refinancing might be a good option.

Benefits of Refinancing

Lower interest rates and reduced EMIs can save you money.

Top Banks and Financial Institutions for Car Loans

Popular Banks Offering Car Loans

Many banks offer competitive car loans. Look into banks like HDFC, ICICI, and SBI for their offerings.

Key Features of Their Car Loan Products

Each bank has unique features like quick approval, flexible tenures, and low-interest rates.

Conclusion

Understanding car loan EMI is essential for anyone looking to finance a car. By knowing how EMI works and what factors affect it, you can make informed decisions and manage your finances better. Remember to compare loan offers, be mindful of your repayment capacity, and consider prepaying your loan to save on interest.

FAQs

How to Choose the Best Car Loan?

Compare interest rates, additional charges, and repayment flexibility from various lenders.

What Happens If I Miss an EMI Payment?

You’ll likely incur a late fee, and your credit score could be negatively affected.

Can I Change My EMI Payment Date?

Some lenders allow changes to the payment date, but it’s best to check with your specific lender.

Is It Better to Have a Longer Loan Tenure?

A longer tenure reduces your EMI but increases the total interest paid. Consider your financial situation before deciding.

Can I Prepay My Car Loan?

Yes, most lenders allow prepayment. Check for any prepayment penalties and weigh the benefits of reducing your loan tenure and interest.