In Brazil, the dream of attaining financial freedom and making the first million is within reach with strategic planning, disciplined saving, and informed investing. As the economic landscape in Brazil continues to evolve, individuals seeking to build wealth can benefit from tailored money-saving tips and investment strategies that take into account the country’s economic conditions. Whether you are a budding entrepreneur, a savvy investor, or a diligent saver, here are practical insights to help you embark on your journey to achieving your first million in Brazil.

Understanding Brazil’s Economy

Before diving into money-saving tips and investment strategies, it is essential to grasp the current economic conditions in Brazil. As the largest economy in South America, Brazil faces unique challenges and opportunities that can impact personal financial goals. From inflation rates and interest rates to government policies and market trends, staying informed about the Brazilian economy is crucial for making informed financial decisions.

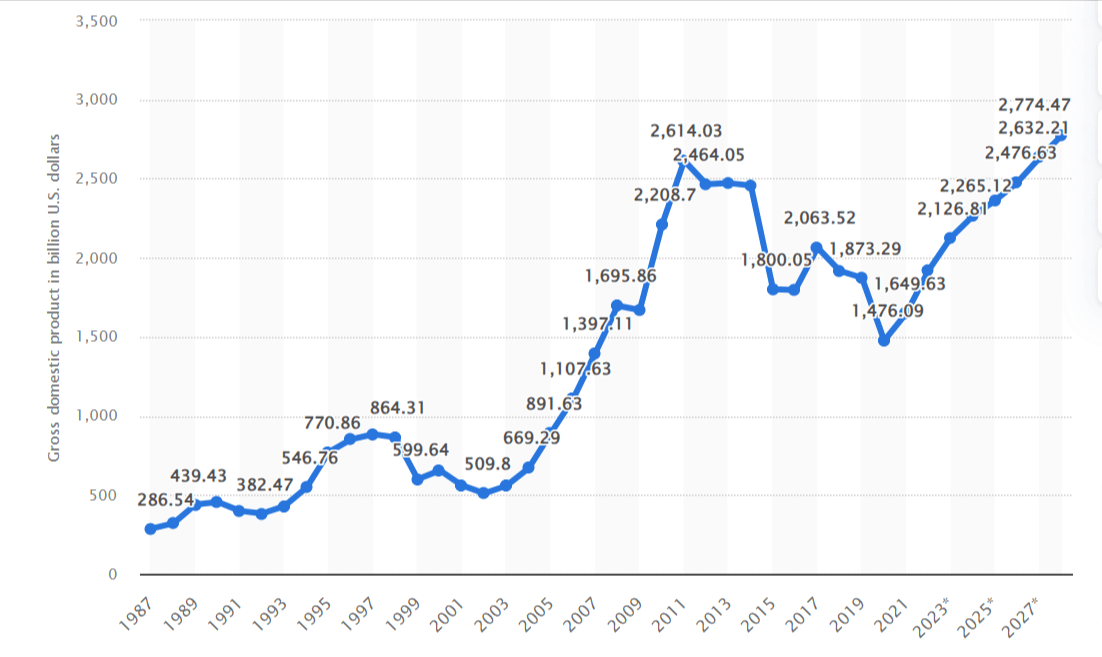

Source: statista

The above image shows Brazil’s Gross Domestic Product (GDP) from 1987 to 2028 (projected).

GDP represents the total value of a nation’s yearly production and highlights Brazil’s impressive growth, ranking it third among BRIC economies (Brazil, Russia, India, China) in 2022. This growth is further underscored by Brazil’s participation in influential economic groups like the G20 and its status as a leading Latin American economy.

While domestic spending remains high, this is typical for developing nations, and the projected 3% budget deficit reflects necessary investments to fuel continued growth. Most Brazilians, confident in their country’s economic future, believe their personal finances will improve alongside Brazil’s rising global standing.

Money-Saving Tips for Making Your First Million In Brazil

1. Cash Discounts and Fintech Solutions:

In Brazil, cash is king when it comes to saving money. Many businesses offer discounts for cash payments, incentivizing customers to opt for paper currency over electronic forms of payment.

For instance, local restaurants or small shops often provide discounts ranging from 5% to 10% for customers who pay in cash instead of using credit or debit cards. Moreover, the rise of fintech solutions in Brazil presents an opportunity for cost-effective financial management.

Apps like Nubank and Mercado Pago offer convenient services for budgeting, transferring money, and paying bills without incurring traditional banking fees. By embracing these fintech platforms, individuals can streamline their financial transactions and avoid unnecessary charges, ultimately saving money in the process. So when we talk about making your first million in Brazil, you can definitely try this method.

2. Utilize Tesouro Direto Bonds:

Tesouro Direto, the Brazilian government bond program, offers individuals a secure avenue for investment in government securities. This initiative enables investors to purchase bonds directly from the government, providing a low-cost and accessible entry point to the bond market.

For example, by investing in Tesouro Selic bonds, investors can benefit from competitive returns that mirror the country’s benchmark interest rate.

By diversifying their investment portfolios with Tesouro Direto bonds, individuals can mitigate risk and capitalize on the stability offered by government-backed securities.

Monitoring bond yields and adjusting investment allocations based on interest rate movements can help investors optimize their bond holdings and achieve long-term financial growth.

3. Stay Informed About Inflation Rates:

Inflation is a persistent economic factor in Brazil that significantly impacts consumers’ purchasing power. Being aware of inflation rates and their implications on the economy is crucial for preserving the value of savings and investments.

With annual inflation rates typically hovering around 2% to 5% in recent years, individuals need to adjust their financial strategies to counteract the effects of rising prices. For instance, investing in inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) can safeguard against inflation erosion and ensure that investments maintain their real value over time.

By monitoring inflation rates and diversifying their investment holdings, individuals can navigate the economic challenges posed by inflation and secure their financial well-being.

4. Shop Local Markets and Seasonal Sales:

Local markets in Brazil offer a treasure trove of fresh produce, meats, and artisanal goods at competitive prices. Opting to shop at these markets, such as the Mercado Municipal in São Paulo or Feira de São Cristóvão in Rio de Janeiro, allows consumers to support local vendors while enjoying cost savings on groceries.

Buyers can access high-quality products at affordable prices by purchasing directly from producers and bypassing traditional supermarkets. Additionally, taking advantage of seasonal sales events can yield substantial discounts on various products.

Whether it’s the Black Friday sales in November or the traditional Carnaval sales in February, consumers can snag deals on electronics, clothing, and household items. Planning purchases around these seasonal promotions enables individuals to maximize their savings and stretch their budgets further.

5. Real Estate Investments:

Real estate investments present a lucrative opportunity for wealth accumulation in Brazil. Investing in rental properties in burgeoning neighborhoods or participating in real estate development projects can generate passive income and capital appreciation.

For instance, acquiring a rental apartment in popular tourist destinations like Florianópolis or Salvador can yield steady rental income and potential property value appreciation over time.

Investment Strategies Aligned with Brazilian Economic Conditions

Navigating the Brazilian investment market requires a keen understanding of the country’s unique economic conditions. Here, we explore various investment strategies that go well with the Brazilian economic conditions

1.Diversified Portfolio

Build a diversified investment portfolio that includes Brazilian stocks, bonds, real estate, and other assets to manage risk and capture growth opportunities within the country’s economy.

- Brazilian Stocks: The Brazilian stock market (B3) offers exposure to various sectors like energy, commodities, financials, and consumer staples. However, Brazilian stocks can be volatile due to fluctuations in global commodity prices and interest rates. Consider investing in established companies with strong fundamentals for long-term growth.

- Brazilian Bonds: Brazilian bonds can provide steady income and act as a hedge against inflation. However, keep an eye on Brazil’s sovereign credit rating, which can impact bond yields. Government bonds tend to be more stable but offer lower returns compared to corporate bonds.

- Real Estate: Brazilian real estate can be a good option for capital appreciation and rental income. However, the market can be cyclical, and regional variations exist. Focus on researching areas with strong economic growth and rental demand.

2.Real Estate Ventures:

Consider investing in Brazilian real estate, taking into account market trends and regional opportunities to generate rental income and capital appreciation.

- Market Trends: Brazil’s real estate market has experienced ups and downs. Research current trends like affordability, mortgage rates, and government incentives for specific sectors like low-income housing.

- Regional Opportunities: The coastal regions tend to be more expensive than interior ones. Look for areas with growing industries or infrastructure projects that could boost property values.

3. Monitor Currency Exchange Rates:

Keep an eye on currency exchange rates to identify favorable investment opportunities that may arise due to fluctuations in the Brazilian Real’s value.

The BRL can be volatile against major currencies like the USD. A weaker BRL can make dollar-denominated investments relatively cheaper. Conversely, a strengthening BRL can improve returns on investments made in Brazil.

4. Tax-Efficient Investments:

Explore tax-efficient investment options in Brazil to maximize your returns and minimize tax liabilities, ensuring that you retain more of your hard-earned money.

Brazil offers investment vehicles like Private Investment Funds (FIIs) that provide tax benefits on dividends and capital gains under certain conditions. Consult a Brazilian financial advisor for suitable options based on your tax profile.

Conclusion

In conclusion, the path to making your first million in Brazil involves a combination of prudent money-saving habits and informed investment decisions. By incorporating tailored money-saving tips and investment strategies that align with Brazil’s economic conditions, you can accelerate your journey toward achieving financial success.