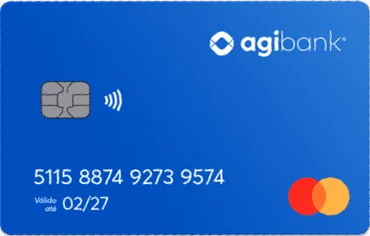

The Agibank credit card, offered by the esteemed digital bank in Brazil, Agibank, is a dynamic financial tool providing customers with a modern and seamless way to manage their finances.

Integrated with Agibank’s digital banking platform, this credit card offers users real-time transaction notifications, budget tracking tools, and personalized spending insights through the mobile app, along with exclusive benefits, rewards, and discounts tailored to their lifestyle.

Pros

![]() Seamless integration with Agibank’s digital banking platform for convenient financial management.

Seamless integration with Agibank’s digital banking platform for convenient financial management.

![]() Commitment to financial inclusion with competitive interest rates, no annual fees, and user-friendly terms.

Commitment to financial inclusion with competitive interest rates, no annual fees, and user-friendly terms.

![]() Features like cashback rewards, installment payment options, and personalized offers for a rewarding banking experience.

Features like cashback rewards, installment payment options, and personalized offers for a rewarding banking experience.

![]() Emphasis on security, convenience, and value-added services to empower users in controlling their finances.

Emphasis on security, convenience, and value-added services to empower users in controlling their finances.

Cons

![]() Benefits and rewards may vary based on individual spending habits and preferences.

Benefits and rewards may vary based on individual spending habits and preferences.

![]() Limited acceptance outside Agibank’s network of partners and affiliates.

Limited acceptance outside Agibank’s network of partners and affiliates.

![]() Potential for additional fees for certain transactions or services.

Potential for additional fees for certain transactions or services.

![]() Requires responsible financial management to avoid overspending or accumulating debt.

Requires responsible financial management to avoid overspending or accumulating debt.

Who should use this Card?

- Perfect for people looking for a card that offers simple cost management and a reasonable yearly fee.

- Those who want financial management and practicality from their mobile device.

- For people who appreciate special perks when making purchases and using services.

- Trusted Bank

- Cashback Rewards

- InstallmentPayment Options

- Online Management

- Additional Benefits

[/mvc_price_listing]

Visit the merchant’s site for detailed information on benefits, interest rates, fees, and eligibility criteria. You can also find exclusive offers or promotions specific to the Agibank credit card!

Just remember, not all cards are the same. We are constantly updating our links and blogs to include these sources. Certain bank accounts also offer better pricing for cards for members.