Compreender sua saúde financeira muitas vezes pode ser resumido a alguns números-chave, e um dos mais significativos é a sua Relação Dívida/Renda.

Essa relação é um indicador crucial de como você gerencia suas dívidas em relação à sua renda, oferecendo uma visão geral da sua estabilidade financeira.

A economia do Brasil inclui altas taxas de juros e pressões inflacionárias, tornando ainda mais crucial o conhecimento da sua Relação Dívida/Renda.

Se você está planejando solicitar uma hipoteca, gerenciar seus empréstimos existentes ou apenas deseja ter maior controle sobre sua situação financeira, calcular sua Relação Dívida/Renda é um excelente ponto de partida.

O que é a Relação Dívida/Renda?

A Relação Dívida/Renda (DTI) é um indicador financeiro que compara o valor da dívida que você paga a cada mês com o valor da sua renda bruta mensal. Ela é expressa como uma porcentagem e é utilizada pelos credores para avaliar sua capacidade de gerenciar os pagamentos mensais e quitar o dinheiro emprestado.

Relação de Pagamento Frontal

A relação de pagamento frontal (ou, em outros termos, a relação de habitação) calcula a porção da sua renda destinada às despesas com habitação. Isso inclui aluguel ou pagamentos mensais de hipoteca, impostos sobre a propriedade, seguro residencial e, em alguns casos, taxas de associação de proprietários.

Relação de Pagamento Traseiro

A relação de pagamento traseiro é mais abrangente e inclui todas as suas obrigações de dívida mensais, não apenas os custos com habitação. Isso pode incluir pagamentos de cartões de crédito, empréstimos de carro, empréstimos estudantis, empréstimos pessoais e quaisquer outras obrigações de dívida recorrentes.

A relação de pagamento traseiro é geralmente considerada mais importante pelos credores no Brasil, pois oferece uma visão mais completa das suas obrigações financeiras.

Por que a Relação Dívida/Renda é Importante?

Sua relação dívida/renda é um indicador crucial da saúde financeira por várias razões:

Aprovação de Empréstimos e Credibilidade Crédito

No Brasil, credores como bancos e cooperativas de crédito utilizam sua relação dívida/renda para avaliar se você pode assumir novas dívidas. Uma relação Relação Dívida/Renda mais baixa indica que você tem um equilíbrio entre dívida e renda, o que o torna um candidato mais atraente para empréstimos, especialmente os maiores, como financiamentos imobiliários.

Taxas de juros e condições de empréstimo

Sua relação dívida/renda pode impactar significativamente as taxas de juros que você receberá. Tomadores de crédito com relações Relação Dívida/Renda mais baixas geralmente qualificam-se para taxas de juros menores, pois são vistos como menos arriscados. Por outro lado, uma relação DTI mais alta pode levar a taxas de juros mais altas ou até mesmo a negativas de empréstimo.

Planejamento Financeiro e Orçamento

Além das aprovações de crédito, conhecer sua relação dívida/renda ajuda a tomar decisões financeiras informadas. Se sua relação dívida/renda for alta, você pode estar sobrecarregado de dívidas e encontrar dificuldades para economizar para emergências ou objetivos futuros.

Como Calcular Sua Relação Dívida/Renda

Para determinar sua relação dívida/renda, siga os seguintes passos:

1. Liste Todos os Pagamentos Mensais de Dívidas:

Faça uma lista completa de todas as suas obrigações mensais de dívida. Isso deve incluir:

- Custos com Habitação: Aluguel ou pagamentos de hipoteca, impostos sobre a propriedade e seguro.

- Pagamentos de Cartão de Crédito: Pagamentos mínimos em todos os cartões de crédito.

- Empréstimos: Empréstimos de carro, empréstimos estudantis, empréstimos pessoais e quaisquer outros empréstimos parcelados.

- Other Debts: Any other recurring debts such as child support, alimony, or any legally binding payments.

2. Determine Sua Renda Bruta Mensal:

Calcule sua renda bruta mensal total, que é sua renda antes de quaisquer impostos ou deduções. Inclua:

- Salário Principal: Sua remuneração mensal do seu emprego principal.

- Bônus e Comissões: Quaisquer bônus, comissões ou incentivos regulares.

- Outras Fontes de Renda: Renda de aluguel, dividendos, renda de trabalho meio período ou quaisquer outras atividades extras.

3. Divida e Multiplique:

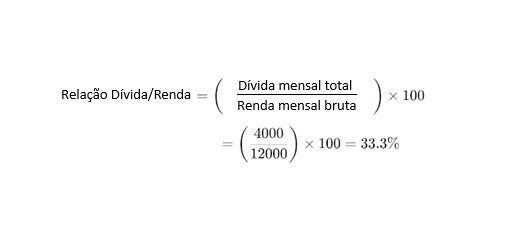

Para encontrar sua relação Dívida/Renda:

- Some todos os seus pagamentos mensais de dívidas.

- Divida essa soma pela sua renda bruta mensal.

- Para obter o valor em porcentagem, basta multiplicá-lo por 100.

Exemplo de Cálculo:

Se o total dos seus pagamentos mensais de dívidas for de R$ 4.000 e sua renda bruta mensal for de R$ 12.000:

Isso significa que 33,3% da sua renda bruta mensal está sendo destinada ao pagamento de dívidas.

Isso significa que 33,3% da sua renda bruta mensal está sendo destinada ao pagamento de dívidas.

Limiares Recomendados da Relação Dívida/Renda no Brasil

Compreender os limiares para uma relação Dívida/Renda saudável é essencial:

1. Relação Dívida/Renda Saudável

Geralmente, uma relação DTI de 30% ou abaixo é considerada saudável no Brasil. Isso indica que você tem uma quantidade de dívida controlável em relação à sua renda, o que é favorável para obter crédito novo.

2. Relação Dívida/Renda de Risco Moderado

Uma relação entre 30% e 40% é considerada administrável, mas pode indicar um potencial aperto financeiro. No Brasil, os credores podem vê-lo como um tomador de crédito de risco moderado e podem impor taxas de juros mais altas ou condições mais rigorosas.

3. Relação Dívida/Renda de Alto Risco

Uma relação dívida/renda acima de 40% é considerada de alto risco. Os credores no Brasil podem relutar em aprovar empréstimos, especialmente para valores significativos, como hipotecas. Essa relação indica que uma parte significativa da sua renda já está comprometida com o pagamento de dívidas, deixando pouco espaço para novas obrigações financeiras.

Compreendendo as Considerações Financeiras Específicas do Brasil

Ao calcular e gerenciar sua relação Dívida/Renda no Brasil, é fundamental estar ciente de diversos fatores financeiros únicos que podem influenciar a dinâmica entre sua dívida e sua renda. Esses fatores, que diferem dos de outros países, podem afetar significativamente a forma como você planeja, calcula e gerencia sua relação Dívida/Renda:

1. Taxas de Inflação:

O Brasil tem uma história de taxas de inflação fluctuantes, frequentemente mais altas do que as observadas em economias mais desenvolvidas. A alta inflação reduz o poder de compra da sua renda, o que significa que, embora sua renda nominal possa permanecer a mesma, seu valor real diminui com o tempo.

Essa erosão do poder de compra pode aumentar o custo de vida, tornando mais difícil cobrir despesas básicas e honrar dívidas.

A inflação pode afetar indiretamente a sua relação dívida/renda ao apertar seu orçamento. À medida que os custos de vida aumentam, você pode ter menos renda disponível para destinar ao pagamento da dívida, o que efetivamente eleva sua relação dívida/renda, mesmo que o valor da sua dívida permaneça inalterado.

Além disso, os salários no Brasil nem sempre acompanham a inflação, o que pode sobrecarregar ainda mais sua situação financeira.

2. Taxas de Juros:

As taxas de juros no Brasil são geralmente altas em comparação com as médias globais, em parte devido ao ambiente econômico do país e à política monetária. O Banco Central do Brasil frequentemente define altas taxas de juros de referência (taxa Selic) para controlar a inflação, o que impacta diretamente as taxas de juros cobradas pelos bancos em empréstimos e cartões de crédito

Consequentemente, os custos de empréstimo no Brasil podem ser significativamente mais altos, o que afeta quanto você paga a cada mês em suas dívidas.

Taxas de juros altas aumentam o custo do empréstimo, o que se traduz em pagamentos mensais de dívida mais altos. Isso significa que uma porção maior da sua renda vai para o pagamento dos juros, em vez do principal, impactando negativamente a sua relação dívida/renda.

Quanto maiores as taxas de juros, mais difícil se torna gerenciar e reduzir sua dívida de forma eficaz.

3. Tipos de Dívidas no Brasil:

Certos tipos de dívidas são mais comuns no Brasil, e cada um deles traz consigo um conjunto próprio de desafios e considerações:

Dívidas de Cartão de Crédito

Os cartões de crédito no Brasil frequentemente têm taxas de juros muito altas—às vezes chegando a 300% ao ano. Essas taxas tornam a dívida de cartão de crédito uma das mais caras de se manter, e ela pode rapidamente sair de controle se não for gerida adequadamente.

A dívida de cartão de crédito com altas taxas de juros pode levar ao aumento rápido dos pagamentos mensais, especialmente se você estiver fazendo apenas o pagamento mínimo. Isso pode inflacionar significativamente a sua relação dívida/renda e dificultar a qualificação para novos créditos ou empréstimos.

Empréstimos Pessoais

Os empréstimos pessoais são uma escolha popular de financiamento no Brasil, especialmente para despesas inesperadas ou para consolidar dívidas. No entanto, esses empréstimos frequentemente vêm com taxas de juros relativamente altas, dependendo do credor e do perfil de crédito do tomador.

Taxas de juros elevadas em empréstimos pessoais significam parcelas mensais maiores, o que pode aumentar seu índice de Dívida sobre Renda. Se você depender fortemente de empréstimos pessoais para gerenciar suas despesas, sua carga de dívidas pode aumentar com o tempo.

Financiamento de Veículos

Muitos brasileiros financiam seus veículos por meio de empréstimos, que podem ser garantidos ou não garantidos. As taxas de juros do financiamento de veículos podem variar bastante, mas geralmente são mais favoráveis do que as taxas de juros dos cartões de crédito.

Os pagamentos mensais de empréstimos de veículos são tipicamente uma obrigação fixa, o que significa que eles contribuem diretamente para a sua razão de dívida por receita. No entanto, como os veículos se depreciam em valor, você pode acabar devendo mais do que o valor do veículo se os termos do empréstimo forem desfavoráveis ou se as taxas de juros forem altas.

4. Taxas de Câmbio:

Se você tiver dívidas em moedas estrangeiras, as flutuações na taxa de câmbio também podem impactar sua relação Dívida/Renda. As taxas de câmbio do Brasil podem ser voláteis, especialmente durante períodos de incerteza econômica, o que pode tornar as dívidas em moeda estrangeira mais caras quando convertidas para Reais.

Se o Real brasileiro se desvalorizar em relação à moeda na qual você tem dívidas, o valor da sua dívida em Reais aumenta, o que eleva seus pagamentos mensais de dívida e sua relação Dívida/Renda (DTI).

Dicas para Melhorar sua Relação Dívida/Renda

Melhorar sua relação Dívida/Renda é crucial para manter a estabilidade financeira, acessar crédito e alcançar seus objetivos financeiros de longo prazo. Uma abordagem equilibrada envolve tanto a redução das dívidas quanto o aumento da sua renda. Aqui estão algumas estratégias eficazes:

1. Reduza os Pagamentos Mensais de Dívidas

Reduzir suas obrigações mensais de dívidas pode melhorar significativamente sua relação Dívida/ Renda. Aqui estão alguns métodos a considerar:

Consolidação de Dívidas

Se você tem várias dívidas, considere consolidá-las em um único empréstimo, preferencialmente com uma taxa de juros mais baixa. A consolidação de dívidas pode simplificar suas finanças, reduzindo o número de pagamentos mensais que você precisa fazer.

Essa estratégia também pode diminuir o valor total do pagamento mensal, ajudando a gerenciar melhor o seu fluxo de caixa.

Procure por credores ou instituições financeiras renomadas que ofereçam empréstimos de consolidação. Compare taxas de juros e taxas, e escolha o empréstimo que ofereça a maior economia.

Certifique-se de calcular o custo total do empréstimo ao longo do tempo para garantir que ele seja vantajoso a longo prazo.

Refinanciamento de Empréstimos

Refinanciar envolve substituir um empréstimo existente por um novo, com condições mais favoráveis, como uma taxa de juros mais baixa ou um prazo de pagamento mais longo. Isso pode reduzir seus pagamentos mensais, facilitando a gestão da sua carga de dívidas.

Procure seu credor atual ou pesquise outras opções em bancos e cooperativas de crédito para encontrar condições de empréstimo melhores. Certifique-se de entender o processo de refinanciamento, as taxas envolvidas e o possível impacto na sua pontuação de crédito.

Lembre-se de que, embora estender o prazo do empréstimo possa reduzir os pagamentos mensais, isso pode aumentar o total de juros pagos ao longo do tempo.

2. Aumente a Renda

Aumentar sua renda pode ajudar a melhorar sua relação Dívida/Renda, aumentando o denominador na equação, reduzindo assim o percentual geral. Aqui estão algumas formas de começar:

Explore Fontes de Renda Adicionais

Diversificar suas fontes de renda pode fornecer uma rede de segurança financeira e melhorar sua relação Dívida/Renda. Considere trabalhar como freelancer, assumir um emprego meio período ou monetizar um hobby.

Por exemplo, se você gosta de fotografia, considere vender suas fotos online, ou se tem experiência em uma área específica, pense em oferecer consultoria ou aulas.

Comece avaliando suas habilidades, interesses e o tempo disponível. Pesquise oportunidades potenciais, como plataformas de freelance, vagas de empregos meio período ou ideias de negócios online. Concentre-se em oportunidades que tenham uma barreira de entrada baixa e um investimento inicial mínimo.

Seja consistente e dedicado ao desenvolvimento dessas fontes de renda ao longo do tempo. Melhorar ou atualizar suas habilidades pode abrir portas para oportunidades de trabalho com salários mais altos.

Invista no Desenvolvimento de Habilidades

Considere fazer cursos, certificações ou participar de workshops para aprimorar suas habilidades. Isso pode levar a promoções, aumentos salariais ou novas oportunidades de emprego.

Conclusão

Compreender e monitorar regularmente sua relação dívida/renda é vital para manter sua saúde financeira. Isso pode ajudar você a tomar decisões informadas sobre contrair novas dívidas, solicitar empréstimos e gerenciar seu orçamento.

No Brasil, onde as condições econômicas podem mudar rapidamente devido à inflação ou flutuações nas taxas de juros, acompanhar sua relação Dívida/Renda é crucial para a estabilidade financeira.